Let me transport you back in time to marketing software’s earliest days: before Salesforce, before Marketo, and even (gasp!) before HubSpot. If you were organizing an enterprise marketing campaign in 1992, there’s one piece of software you’d turn to as you fired up Windows 3.1 on your Compaq computer: Unica. With features including marketing campaign management and lead management, it was a pioneer.

We’ve come a long way since then. What we refer to today as “marketing automation” originally focused on lead generation and email marketing. But as the popularity of the internet grew, the industry changed. Today, marketing automation software covers everything from cross-platform automation to social listening to predictive analytics.

The marketing automation market size is now massive, worth nearly six billion dollars and growing fast: in 2024 there were 14,106 MarTech products according to The 2024 State of Martech Report—double the number of software that existed five years earlier.

In this article, I’ll walk you through the history of marketing automation: the first vendors, the addition of social media, the massive acquisitions and consolidation, and what you can expect from the future of the industry.

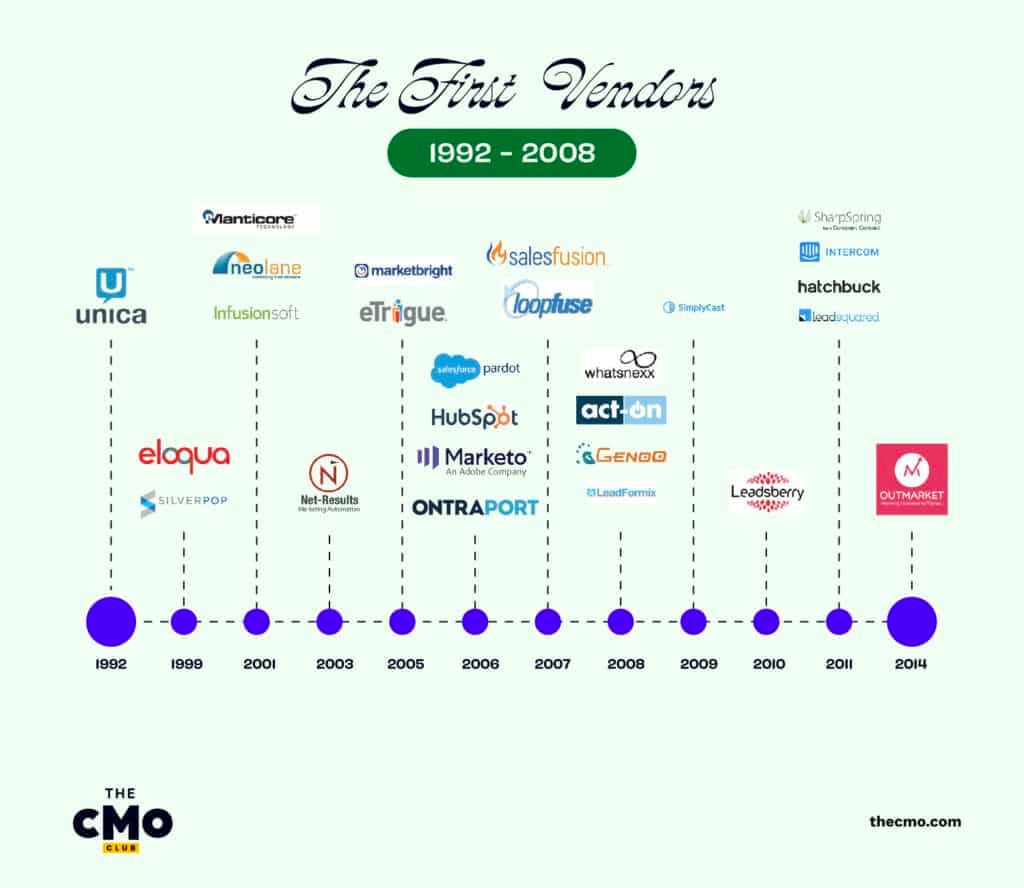

The First Vendors (1992-2008)

Unica’s “Enterprise Marketing Management” (EMM) software, launched in 1992, showed users there was a better way to manage marketing campaigns. Still, there was a problem: there were only 6 million internet users—in the entire world. While enterprise users of software like Unica were among the first to go online, the internet’s small user base was a cap on the broader usefulness of marketing automation software.

By 1999, the number of internet users had grown by nearly 50x to 280 million. It was in this environment that two game-changing products launched: Eloqua and Salesforce. Eloqua—later acquired by Oracle—is considered the first modern marketing automation solution, launching features like lead scoring.

Meanwhile, Salesforce democratized access to customer relationship management (CRM) software, making it substantially cheaper and charging per seat; as more companies digitized their records into CRM systems, marketing automation solutions like Eloqua had a bigger market to cater to.

The success of Eloqua inspired a legion of competitors in the early 2000s, including Infusionsoft, Neolane, and Marketbright. 2006 was a key year in the world of marketing automation: HubSpot, Pardot, and Marketo all launched. These three giants still dominate the world of marketing automation today—though Pardot was later acquired by Salesforce, and Marketo by Adobe.

Email Marketing Takes On Social Media (2000-2010)

In the mid-2000s, the landscape of social media started to take shape. LinkedIn opened its doors in 2003, Facebook launched in 2004, Twitter was released in 2006, and plenty of other now-defunct platforms rose and fell. As users flocked to social media, marketing automation tools realized that their scope needed to expand beyond just email marketing.

This was especially true for HubSpot, which coined the phrase “inbound marketing” and was a pioneer in multichannel marketing automation. According to Brian Halligan, a cofounder of HubSpot, adding social media and other forms of inbound to the marketing automation mix made for a better experience for everyone: inbound marketing automation meant “pulling people in through Google, through search, through social, through blogging. Versus outbound marketing… interrupting people in their daily lives, and that the world would be a better place if inbound was more prevalent than outbound.”

As marketing automation tools moved beyond email and added social media channels, it represented a significant step toward the omnichannel, all-in-one marketing platforms that they’ve become today.

The Acquisition Years (2010-2018)

In 2012, ExactTarget acquired Pardot for $95 million. At the time, news outlets said this enabled ExactTarget to better compete with companies like Salesforce. But just nine months later, Salesforce bought ExactTarget for $2.5 billion—acquiring Pardot in the process, too.

The Pardot-ExactTarget-Salesforce chain of acquisitions was perhaps the juiciest bit of tech consolidation drama in the marketing automation world in the 2010s, but it was far from the only example. The years 2010-2018 were an especially acquisitive time: IBM bought Unica for $480 million in 2010; Oracle acquired Eloqua $871 million in 2012; and Adobe bought Neolane for $600 million in 2013 before signing a deal to acquire Marketo for $4.5 billion in 2018.

Other acquisitions happened for undisclosed sums, including Act-On’s 2011 purchase of Marketbright, HubSpot’s 2011 acquisition of Performable, and Marketo’s 2012 purchase of CrowdFactory.

The net effect of all of this acquisition? The digital marketing automation space was increasingly dominated by big players like HubSpot, Salesforce, and Adobe. Still, prices for users didn’t shoot up as a result of this consolidation; much of it was a result of “feature-led acquisitions” to boost product capabilities in areas like social media, analytics, and AI.

Major Market Fluctuations (2019-2024)

At the dawn of the 2020s, two crucial things happened in the marketing automation space.

First, remote work boomed in 2020 as a global pandemic forced companies to quickly adopt work from home policies. To coordinate marketing processes among a distributed team, automation became more important than ever before; marketing automation platforms surged in number of users and profits, with the market capitalization of companies like Salesforce, Adobe, and HubSpot increasing by as much as 2-5x from 2019-2021. This temporary increase in demand led some firms to overhire; by 2022, Oracle was forced to cut 5,000 jobs in its customer experience and marketing divisions.

Second, AI-powered marketing automation became a “must have” after OpenAI’s ChatGPT, which was released in 2022, gained 100 million users in just two months. Some marketing automation platforms—like Salesforce with its Einstein AI tool—had been incorporating AI for years. But for most, it wasn’t a focus. After ChatGPT, that changed: by 2023, companies from Mailchimp to Klaviyo were repositioning their products around artificial intelligence, with features like predictive analytics and generative content creation becoming widespread.

Evolution Of Marketing Automation (2024+)

If there’s one thing we know, it’s this: reliance on marketing automation keeps growing. After all, there are plenty of marketing automation case studies out there showing the power of its potential.

On Cyber Monday, 2023, ActiveCampaign recorded an all-time record of 1.4 billion automations in a single day. And the value of the industry as a whole is projected to more than double to $15 billion by 2029 (an annual growth rate of 17%) according to Mordor Intelligence. As adoption of digital marketing automation continues to expand into the mid-and-late 2020s, here are some other marketing trends to watch.

Lower costs

The pricing of marketing automation will continue to drop. Today, there is a vast gap between enterprise marketing automation solutions (which often start at $1,000+/month or more) and small business software, which is typically under $100/month. As more emerging martech startups come onto the market, and as small business software gets more capable, expect this gap to narrow.

Niche platforms

Keep an eye out for niche marketing automation tools with industry-specific workflows and regulatory compliance. There are certain sectors that need unique considerations; healthcare, with its need for patient confidentiality, is one of them. Already, Zoho has a HIPAA-compliant marketing automation solution. Other sectors, like finance and legal, have unique marketing automation needs too.

Artificial intelligence

Marketing automation platforms are infusing AI and machine learning throughout their products, but two applications stand out: predictive analytics and generative AI. Predictive analytics can make sense of the vast quantities of data generated by CRMs and customer behavior, crunching numbers to estimate which leads will convert or how much individual customers are likely to spend for the year. And generative AI streamlines one of the top five pain points experienced by automation specialists: generating all the content needed for an ever-growing number of custom, personalized automations.

Omnichannel personalization

The term “omnichannel” has been on marketing automation trend lists for at least a decade; the difference now is that AI makes cross-platform content, segmentation, and personalization much easier than before. Generative AI features make it quick to create platform-native versions of content for each channel, while AI-augmented personalization and lead nurturing means that it’s simpler than it used to be to target customers who are likely to be receptive to your message. Finally, AI-powered tools like chatbots make it easier than ever to reach customers on whatever platform they prefer—driving more conversions in the process.

The Top Marketing Automation Platforms Today

I realize I’ve name dropped a lot of great marketing automation software options in this article, and chances are your head is swimming with information. For this reason, The CMO has a great list of their top recommended platforms, and if you’re still stuck on how to choose your marketing automation tool, reach out! There are specialists on standby.

Whichever tool you choose, make sure you follow marketing automation best practices so you can make the most of your chosen platform.

Join For More Marketing Automation Insights

We’ve come a long way since Unica and Eloqua released their platforms in the 1990s. Not only has marketing software exploded since then—swelling to thousands of vendors—but marketing automation trends have changed and platforms have evolved from relatively simple email marketing tools to all-in-one apps that strive to unify sales teams and marketing teams.

There have been plenty of changes along the way, especially during the consolidation-heavy years of the 2010s and with the AI-driven shifts of the 2020s. While some of these events boosted the marketing automation market’s fortunes, the popularity of the category has also attracted scores of new software providers, resulting in increased competition.

On the road ahead, expect platforms to continue lowering costs as competition increases; omnichannel personalization and niche marketing tools specializing in areas like HIPAA-compliant marketing are two other trends to watch. AI will continue to have strong effects on the market, streamlining repetitive tasks and opening the door to new creative possibilities.

Ready for more strategic insights into the world of marketing automation? Check out our guide to localized marketing automation and subscribe to The CMO newsletter for regular leadership insights, marketing strategies, and industry updates straight to your inbox.