If you know what it's like to bake a soufflé only to have it fall flat, you know what it's like to put effort into your marketing only to have customers move on. High customer churn can be hugely disappointing with its combination of lost revenue and the cost of acquiring new customers to replace the ones who left. Thankfully, there are strategies you can use to reduce customer churn.

In this no-nonsense guide, I'll share seven actionable ways to minimize churn and help you retain customers. Expect insights into analyzing churn indicators and optimizing customer service, all focused on concrete retention results.

What Is Customer Churn?

Customer churn is when your existing customers stop doing business with you, ultimately ending their relationship with your company. This really is the silent killer of growing businesses because each customer who leaves takes a piece of your revenue and potential growth with them.

This is why understanding and mitigating churn is so crucial—it's not just about losing a customer; it's about the long-term health and success of your business.

How is customer churn measured?

Customer churn can be measured in a variety of different ways, like:

- The number of customers lost

- The value of recurring business lost

- The percentage of recurring value lost

To calculate your customer churn rate, divide the number of customers lost by the total number of customers at the beginning of the period. Then, multiply the result by 100 for your percentage. There may also be a dashboard in your marketing software showing what your churn rate is among other analytics.

Why It's Important To Reduce Customer Churn

Churn is much more than a metric; it's the pulse of your business's customer satisfaction and loyalty. Here are some solid reasons why you should pay close attention to it:

Customer churn directly impacts your bottom line

According to Accenture, companies lose $1.6 trillion per year due to customer churn. And according to a study by Bain & Company, increasing customer retention rates by just 5% can boost profits by 25% to 95%.

Ignoring churn can mean leaving significant revenue on the table, and for businesses operating on thin margins, this can be the difference between growth and stagnation.

Customer churn actually costs you more money

According to Forrester, it costs 5 times more to acquire new customers than it does to keep an existing one, so if you have to replace the customers that churn, you're looking at spending more right out of your pocket.

So not only do you leave that significant revenue on the table, but now you're paying to do so. Working on your customer retention strategy to reduce customer churn saves you major bucks, both through lost sales and expenses.

Churn can signal deeper issues with customer satisfaction

A report by Customer Contact Week Digital states that 78% of consumers will abandon a purchase if their customer service experience is unsatisfactory.

This is a stark reminder that churn isn't just about lost sales; it's a warning sign of potential systemic problems that can erode your brand's reputation if left unchecked. So, how can you identify the warning signs of churn and take action before it's too late? Let's dig in.

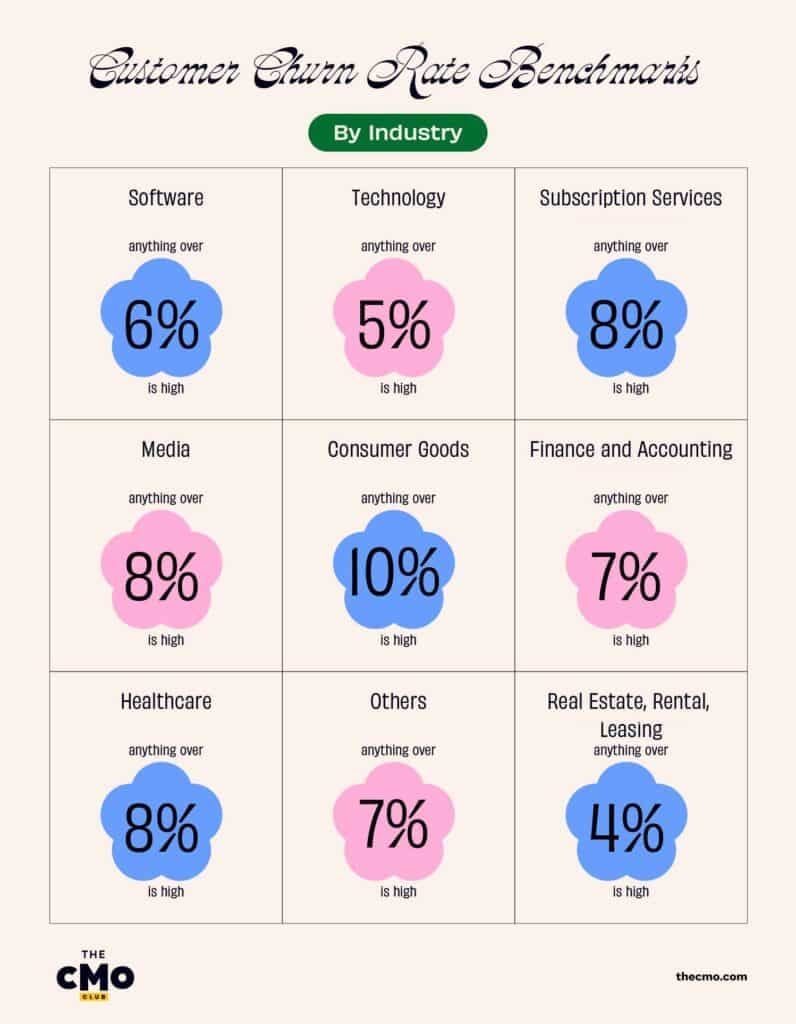

Customer Churn Rate Benchmarks By Industry

If you've calculated your churn rate, chances are you need a benchmark to compare it to in order to know where you stand. Benchmarks can vary depending on the industry, so it’s essential to determine which are the most relevant to your company.

Here are some average churn rates for various industries:

While I'll do my best to regularly update this article and keep these numbers fresh, it's always a good idea to do some of your own research to assess the state of the market and average churn rates at any particular point in time.

Identifying Churn Indicators

Even if you're doing okay right now, you'll still want to be notified of warning signs and identify at-risk customers if and when they come. Here are a few methods you can use to uncover subtle trends and patterns that may otherwise go unnoticed, potentially saving your existing customers.

- Churn prediction models can reduce bias and human error while scaling data analysis to recognize subtle trends and patterns that indicate the risk of churn.

- Customer cohort analysis defines early-stage retention periods, helping you understand critical times when users tend to disengage from a product.

- Purchase history, including frequency and value of orders, can reflect behavioral changes in customers that may lead to churn.

- Analyzing where customers face issues or stalls in the product lifecycle can help you identify those who are at risk of churning.

To better predict customer churn, segment customers by their profitability, readiness to leave, and likelihood to respond positively to retention efforts. This will help your customer success team keep an eye on things so you can work to reduce customer churn as you see it coming.

How To Reduce Customer Churn

1. Analyze what's causing customer churn

Did you know that according to SuperOffice, 68% of customers leave because they think a company doesn’t care about them? While that may not be the case for you, it's worth taking a look at whether customers could interpret certain variables to come to that conclusion.

The easiest way to find out what's causing customer churn is to speak directly with your existing customers—and I highly recommend you do so by phone. Though time-consuming, it allows you to gather valuable voice of customer feedback while demonstrating that you genuinely care on a personal level. Plus, it may reveal other reasons why customers churn, such as:

- The price is too high

- The product is of poor quality

- The product has a poor user experience

- The cross-selling or up-selling is too aggressive

- The customer service is poor

- A competitor convinced them to try their product

2. Define your churn goals

Okay, we know that you want to reduce customer churn, but to make this actionable you need to quantify your goal and break it down into smaller goals. This is what will help you measure your progress and success in the long run.

Some examples of goals that lead to reducing customer churn can look like:

- Survey a portion of your churned customers by phone to gather actionable feedback.

- Improve the onboarding process to reduce early-stage churn by 15% within the next quarter.

- Implement a customer service initiative targeting at-risk customers within the next 60 days.

- Launch a customer loyalty program and enroll at least 1,000 customers within three months.

- Increase the Net Promoter Score (NPS) by 10 points within six months.

- Reduce the customer churn rate by 2% over the next quarter.

By setting up small steps (with their own unique deadlines) that all lead to your 'reduce churn rate' goal, you're far more likely to see success.

3. Be proactive with customer service

Actively identifying and solving customer problems before they affect the experience can prevent the potentially devastating impact of poor service. Proactive churn prevention includes using data for predicting customer happiness and dissatisfaction, engaging with at-risk customers, listening to their needs, and resolving identified issues promptly.

Make sure you always attend to customer complaints, respond to feedback on review sites with a commitment to quality care, and show a dedication to improvement through surveys and rating requests. Personalizing customer relationships and implementing marketing automation to respond to queries can enhance the overall customer experience, further reducing churn rates.

4. Enhance the user experience

Enhancing the user experience and optimizing the marketing funnel is also important in maintaining customer satisfaction and reducing churn. I've found that streamlining the onboarding process can significantly improve user retention, with statistics showing a 15% increase in the first week and nearly twice the user retention after ten weeks.

Personalizing the onboarding experience ensures new customers recognize the product's relevance to their needs, which is key in reducing churn. Consistently providing value through new content keeps users engaged and reduces the risk of them leaving.

Here are some actionable steps you can take to enhance the user experience:

- Streamline the onboarding process with intuitive guides and interactive tours.

- Personalize the onboarding experience with welcome surveys and in-app messages. There's some great MarTech that can help you do this.

- Regularly update your content to provide ongoing value and engagement.

- Invest in analytics to test and measure user interactions, helping you identify areas for improvement and better understand your users.

5. Leverage customer feedback

Feedback from your existing customers is pure gold, and it can be transformative in reducing churn. Take those churn surveys you conducted as part of your actionable goals—this feedback provides perspectives that may not be captured by satisfied customers or net promoter score assessments.

Once you have all your customer feedback in, segment it by challenges, usage, and preferences to pinpoint dissatisfaction reasons, preventing customers from switching to competitors. Implementing changes based on feedback, responding promptly, and creating a customer feedback loop can reinforce the association customers have with the product, keeping it top-of-mind and improving retention efforts.

6. Build customer loyalty programs

Everybody loves a good customer loyalty program, and it can be a great strategic asset in the battle against churn. By focusing on building long-term engagement, loyalty programs ensure customers have compelling reasons to continue their relationship with your brand. Offering incentives throughout the customer journey and continually adding value through new features can fortify customer loyalty and commitment, encouraging them to stay engaged over time.

Some key benefits of loyalty programs include:

- Increased retention of high-value customers

- Higher customer lifetime value

- Increased customer satisfaction and loyalty

- Enhanced brand reputation and customer advocacy

It’s important that your loyalty program balances the cost of incentives with the revenue retained from customers, ensuring that the reduction in churn is cost-effective. If you're looking to learn more, we've got a great list of loyalty marketing courses to get you started.

Celebrating your customer successes can also strengthen loyalty by reminding them of the long-term value and benefits of staying with the product, incentivizing ongoing engagement.

7. Monitor and adjust your strategy

The churn reduction process is an experimental phase where strategies are tested, results are analyzed, and experiments are repeated to enhance their effectiveness. Regularly reviewing your strategy ensures that it stays effective, helping you to identify areas for improvement and refine your approach to meet the evolving needs of your customer base.

Tracking the right metrics is of course vitally important, so make sure you keep a close eye on the following numbers:

- Customer Churn Rate: The percentage of customers who leave over a specific period. This is the most direct measure of churn.

- Customer Lifetime Value (CLV): The total revenue a business can expect from a single customer account. Higher CLV indicates better retention.

- Net Promoter Score (NPS): A measure of customer satisfaction and loyalty based on how likely customers are to recommend your business to others.

- Repeat Purchase Rate: The percentage of customers who make more than one purchase. This indicates the level of customer loyalty.

- Retention Rate: The percentage of customers who stay over a specific period. This is the inverse of the churn rate and an important measure of success.

Join For More Expert Marketing Advice

Throughout this article, I've covered not only what customer churn is and how it's measured, but the steps you can take to prevent it. From understanding the underlying causes to leveraging customer feedback, each strategy plays a crucial role in fostering customer loyalty and reducing attrition.

As we wrap up, remember that the journey to prevent customer churn is ongoing and requires vigilance, creativity, and a willingness to adapt. You'll need feedback directly from your customers, lots of other customer data, and marketing software that supports segmentation to organize that feedback in a way that leads to change.

Key Takeaways

- Understanding and reducing customer churn is critical for business success, as it affects revenue, growth, and company reputation.

- Identifying churn indicators such as changing usage patterns, customer interaction, and billing behavior can help you predict and preemptively address potential losses, customizing your response to individual needs.

- Building loyalty programs that reward customer engagement and personalizing marketing solutions based on customer preferences can enhance customer retention and reduce the likelihood of churn.

If you enjoyed this article or found it helpful in building your strategy to reduce customer churn and retain new customers, be sure to subscribe to The CMO newsletter! We'll send more great insights straight to your inbox.

Frequently Asked Questions

How is customer churn calculated?

To calculate customer churn, divide the number of customers who left by the total number of customers at the start of the period and multiply by 100 to get the percentage. This helps you measure how many customers you’ve lost over a specific period.

What are some early indicators of customer churn?

Early indicators of customer churn can include changes in usage patterns, a decline in customer interaction, and irregular billing and payment behavior. Keeping an eye on these factors can help you identify potential churn early on.

How can proactive customer service reduce churn?

Proactive customer service reduces churn by identifying and solving customer problems before they impact the customer experience and engaging with at-risk customers. Integrating customer support tools with loyalty programs also plays a key role in reducing churn.

Why is continuous improvement important in churn reduction strategies?

Continuous improvement is important in churn reduction strategies because it ensures that retention strategies remain effective, adapt to changing customer needs, and contribute to sustainable business growth. It helps the business stay relevant and meet customer needs effectively.

Can implementing a customer loyalty program really reduce churn?

Yes, implementing a customer loyalty program can reduce churn by providing incentives, rewarding loyalty, and enhancing the overall customer experience. Try it out for your business!