For a look at how the marketing automation industry has changed over time, I fired up the Wayback Machine, a database of old versions of websites, and dug through the internet archives. In 2001, here’s how Eloqua—creator of what’s now considered to be the first true marketing automation tool—described its product: a “web based sales application for lead generation.” In 2003, it was a “complete solution that leverages the Internet to acquire new customers.” (Accurate, but a bit vague). It wasn’t until 2008 that the term “marketing automation” started to dominate the copy on Eloqua’s website.

Marketing automation has come a long way since then. What started as a tool that essentially combined CRM and email marketing has evolved into an all-in-one marketing powerhouse; today’s marketing automation platforms often include features as diverse as SMS marketing, review management, and AI-driven predictive analytics.

As marketing automation’s scope has increased, the size of the market and the number of players involved has grown, too. In this article, I’ll walk you through the evolution of marketing automation—trends, history, market overview, key players, opportunities, and challenges—so you can come away with a fuller understanding of the industry’s past and future.

The Marketing Automation Software Market

In 2024, Motor Intelligence reported that the global marketing automation market was worth $6.85 billion dollars. Since the first generation of marketing automation software was released in the 1990s, pricing has become more affordable and the market has expanded from only enterprise customers to small businesses. According to Hubspot’s 2021 State of Marketing survey, 76% of companies now use marketing automation.

Where are we going from here? Analysts say the industry will continue to grow, with projections that it will reach $15.36 billion by 2029, a compound annual growth rate (CAGR) of more than 17% annually over the forecast period. Businesses are continuing to spend more on marketing; as marketing departments pursue efficiency and scale, plenty of that investment ends up in marketing automation.

Market trends and growth factors

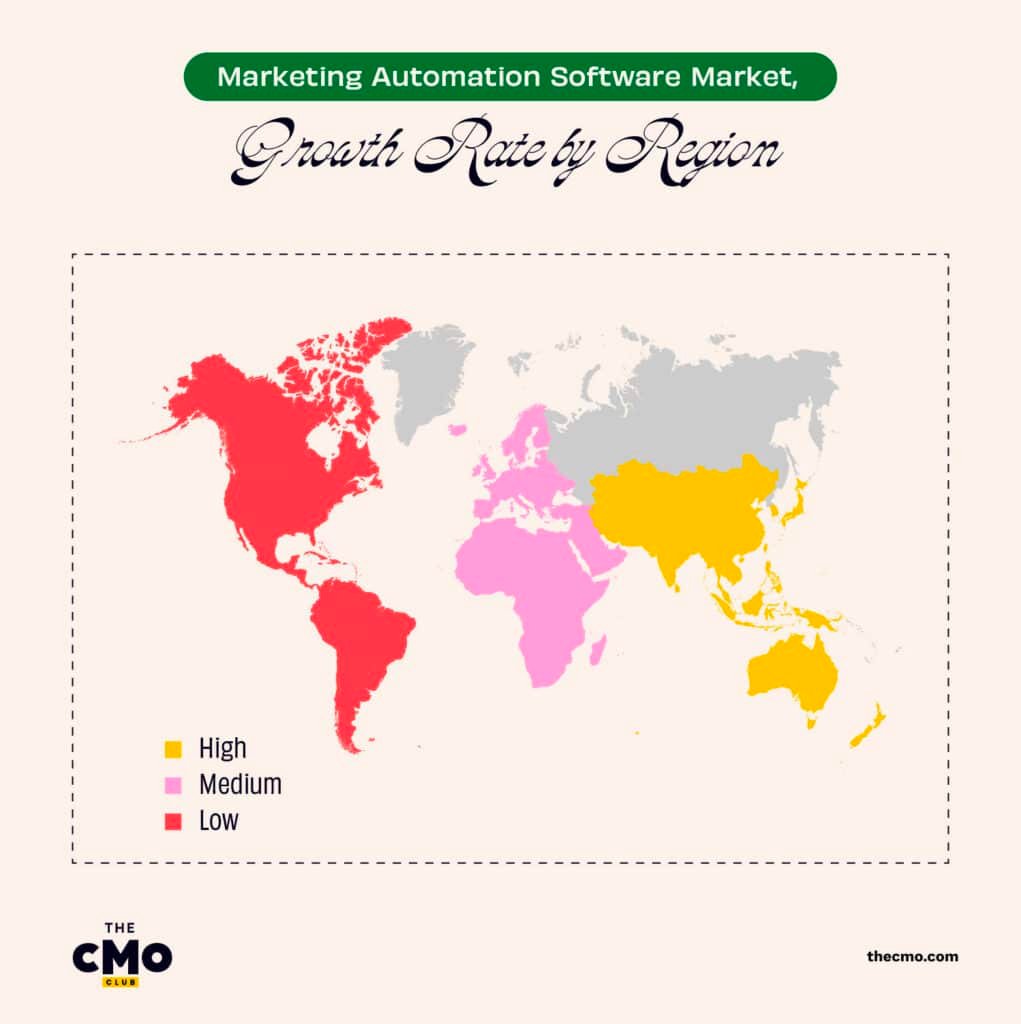

North America is the base of operations for many marketing automation companies, including Adobe, Salesforce, HubSpot, Marketo, and Oracle. As a result, the North American market, including the United States, Canada, and Mexico, experiences steady regional growth. But the fastest-growing region overall is Asia-Pacific, including China and Japan, due to a surge of regional investment in digital marketing and cloud computing. Europe, as well as the Middle East & Africa, are the slowest-growing regions.

Regional differences aside, there are a number of trends driving the marketing automation industry. Here are two of the most prominent.

Omnichannel marketing

Klaviyo, a marketing automation tool used by eCommerce brands like ButcherBox and Hydro Flask, provides a good example of how marketing automation tools have embraced omnichannel marketing. You can use Klaviyo to deliver personalized cross-platform customer experiences that make customers more likely to convert; then, after users complete a purchase, you can set up follow-up automations that span email, SMS, and mobile push notifications—all from a single cloud-based platform.

This kind of sophistication is common in today’s marketing automation landscape, not just with enterprise marketing software like Salesforce but also with smaller SaaS startups. The playing field is being leveled, and small businesses are benefiting as omnichannel marketing automation becomes more accessible than ever. Psst.. it's also a best practice!

Optimizing spend

Businesses look at marketing automation like factories look at physical automation: it’s used to create more reliable, efficient processes (and reduce the potential for human error.) By deploying a marketing automation solution, businesses are able to squeeze more bang out of every buck; Nucleus Research estimates marketing automation’s ROI at 5.44x. That’s because it empowers businesses to save valuable (and expensive) staff attention, boost the value of each customer, and improve decision-making with data.

Here are some of the most impactful ways marketing automation helps optimize spend:

- Eliminating repetitive processes, which saves time and resources.

- Scaling processes that would be impossible to do manually (such as emailing a welcome sequence to every new subscriber).

- Personalizing marketing, which avoids wasting resources by sending the wrong message to the wrong customer.

- Optimizing customer relationship management by automating check-in and lead nurturing, which helps businesses scale while maintaining customer service standards.

Restraining factors

Few experienced professionals

Even if you were proficient in Infusionsoft or Marketo in the early 2010s, your skills would need some serious updates to use the latest crop of AI-powered and personalization-focused tools. That presents a problem: the technology is advancing so fast that there aren’t enough truly qualified marketing professionals.

A 2023 marketing automation report by the University of Hamburg found that while 80% of companies are looking to hire new employees to operationalize marketing automation, a lack of suitable candidates leads many to rely on outside consulting instead. Finding talent is one of the biggest challenges facing marketing leaders, according to a 2024 survey by Robert Half, a recruiting firm; the survey found that 36% of marketing leaders have a hard time finding talent in the marketing automation space.

This scarcity of talent acts as a drag on the growth of the market: companies that can’t staff their marketing teams with automation specialists are less likely to develop automation-based marketing campaigns or invest in marketing automation software.

Security and privacy concerns

In 2021, a T-Mobile data breach ended up costing the company $350 million dollars in customer payouts after names, home addresses, and even Social Security numbers were leaked. And that massive figure doesn’t cover the intangible damage to brand reputation and customer relationships. Sadly, data breaches aren’t rare. Cyber Security Hub reports that in 2022, there were 4,100 publicly-disclosed data breaches which exposed a total of 22 billion records. Revolut, SHEIN, and Twitter are just a few of the prominent brands that have had recent breaches.

If you’re running marketing automation campaigns, you’re collecting data about customers: names, email addresses, preferences, and behavioral data. Some industries, like finance and healthcare, deal with even more sensitive information. It’s critical to maintain data security to avoid a loss of trust with customers. To deal with this risk, digital marketing automation platforms need to ensure asset security by passing SOC 2 compliance audits and requiring end-users to use two-factor authentication, among other security measures.

Opportunities

Artificial intelligence and machine learning

What do HubSpot, Salesforce, Klaviyo, and Mailchimp have in common? Most obviously, they’re all marketing automation platforms. But more interestingly, if you browse their websites you’ll notice they have something strikingly specific in common: they have all reshaped their products around artificial intelligence. This is no accident.

AI, while not a silver bullet, has a tremendous ripple effect across the activities possible to do within marketing automation software. It can lead to smarter insights, better customer messaging, more efficient testing, superior automations, and more relevant personalization.

From customer journey analytics to personalized recommendations, as AI is reshaping what’s possible with marketing automation software.

Acquisitions and new product launches

In the first few years of the 2010s, Salesforce, Hubspot, Marketo, Act-On, and Adobe all made significant acquisitions in the marketing automation space. Today, acquisitions and mergers are again on the table; in 2021, for example, Intuit acquired Mailchimp. With the advent of AI, more marketing automation tools are expected to be “everything apps” that range from CRM to an AI-infused creativity suite.

As marketing automation software can do more things, whether via acquisitions or product development, the industry can take up an ever-bigger piece of the pie in general—and bring in more users. New product launches can help bring in users too, helping to grow the industry at large. Infusing AI features across marketing automation software is one current way to attract new customers while increasing “stickiness” with current customers; HubSpot AI, which includes a chatbot, website generator, and content writer, is a good example of this.

Challenges

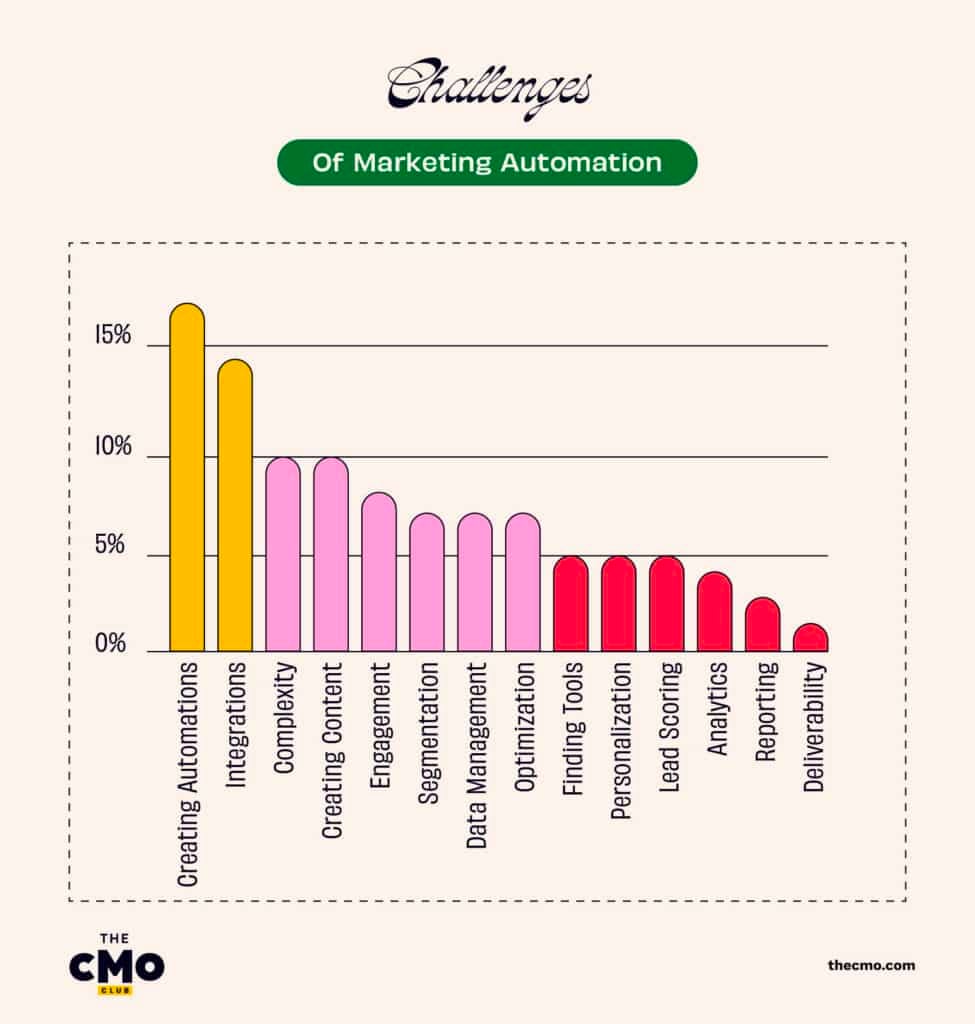

A 2019 survey by Automizy asked dozens of marketing leaders about their greatest challenge related to marketing automation. Most commonly, marketers identified:

- Challenging to create quality automations

- Hard to set up and manage integrations

- Complexity of implementing marketing automation

- Difficulty generating all the content needed for automations

- Challenging to drive customer engagement on automated content

Integration with other business applications

Pablo Rueda, a former Partner Manager at Selligent, a marketing platform, points out that most companies implementing marketing automation first struggle with data silos and integrations. As MarTech stacks have swelled in size over the years, it’s increasingly common for companies to adopt a new marketing platform—only to find out that it doesn’t play nicely with other essential tools in their MarTech stack.

This isn’t an easy problem to solve; more software is being created all the time, and much of it is too niche to justify a native integration with all of the major marketing automation tools. Platforms have a wide range of integration capabilities; HubSpot offers 1,000+ integrations, for example, while Creatio has a few hundred. To fill in the gaps, users often turn to tools like Zapier, which can create custom automations between apps, or develop their own customer integrations. But this, too, takes time and resources to manage.

Major Players In Marketing Automation Software

According to marketing automation software data from Datanyze, in 2024 HubSpot had the largest market share in the industry with 38.32%. Other significant market players include Oracle Marketing Cloud, Adobe Experience Cloud, Active Campaign, Salesforce, and Marketo.

There is significant regional variation in the competitive landscape. For example, RD Station is the largest marketing automation company in Latin America.

- Adobe (US)

- IBM (US)

- Oracle (US)

- HubSpot, Inc (US)

- Salesforce (US)

- Creatio (US)

- RD Station (Brazil)

- Microsoft (US)

- Zoho (India)

- Act-On Software, Inc (US)

- Sage Group plc (UK)

- Klaviyo (US)

- Brevo (France)

- SharpSpring (US)

- Drip (US)

Key Industry Developments

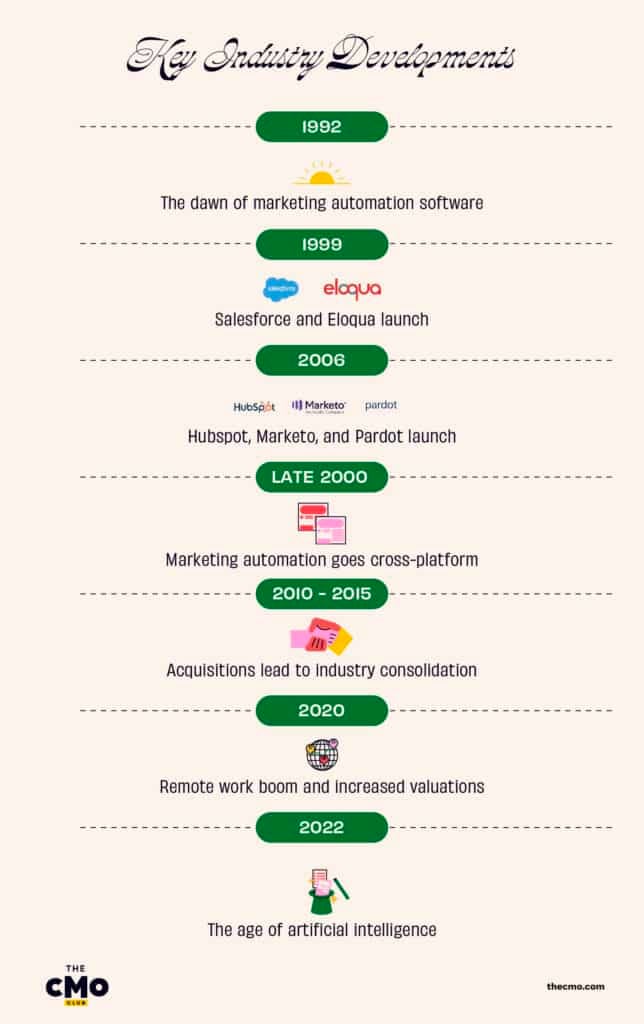

From the email-centric era of the 1990s to the omnichannel, all-in-one AI marketing platforms of the 2020s, here’s a bit of marketing automation history and how the industry has progressed over the years.

- 2022: The age of artificial intelligence. While AI tools like Salesforce Einstein have been available since 2016, the launch of ChatGPT in 2022 (along with other large language models) quickly made AI features a “must have” instead of a “nice to have” for consumers. Marketing automation platforms responded; by 2023, firms from Klaviyo to Mailchimp to HubSpot had integrated AI into features like content creation, campaign management, automation design, and analytics.

- 2020: Remote work boom and increased valuations. As the work-from-home trend took off in 2020, the adoption of marketing automation soared as businesses worked to sync remote employees. Market capitalizations of major marketing automation firms grew quickly during this period: from 2019-2021, Salesforce’s market cap grew by 2x, Adobe’s expanded by 3x, and HubSpot’s experienced 5x growth.

- 2010-2015: Billions of dollars of acquisitions lead to industry consolidation. The early 2010s were a time of acquisition in the marketing automation industry. Just a few of the highlights: in 2010, IBM acquired Unica. In 2011, Act-On acquired Marketbright, Teradata acquired Aprimo, and HubSpot bought Performable. In 2012, Oracle bought Eloqua; Microsoft acquired MarketingPilot; and Marketo acquired CrowdFactory. And in 2013, Salesforce acquired ExactTarget, Adobe acquired Neolane, and Marketo bought Insightera.

- Late 2000s: As social media flourishes, marketing automation goes cross-platform. Social media marketing was the big story of the latter half of the decade. As social media platforms exploded, companies needed a solution to manage their cross-platform communications. Marketing automation platforms filled that need, expanding beyond email to social media; other common features added around this time included A/B testing, webinar features, and landing pages.

- 2006: HubSpot, Marketo, and Pardot launch; the industry gets crowded. As the adoption of the internet grew and digitalization fueled the use of CRMs—and as other companies saw the success of Eloqua—the scope of the opportunity in marketing automation became more apparent. In the early 2000s, marketing automation brands like Infusionsoft came onto the scene; by 2006, heavyweights like Pardot, HubSpot, Marketo, and Ontraport had launched.

- 1999: Salesforce and Eloqua launch. Salesforce, released in 1999, changed expectations of what a customer relationship management (CRM) platform was capable of. In the same year, Eloqua was released; Eloqua—which was later acquired by Oracle—is considered the first true marketing automation platform.

- 1992: The seeds of marketing automation are planted. Software released in the early part of the decade planted the seeds for marketing automation, marked by companies like Unica (later acquired by IBM), which in 1992 released its “enterprise marketing management software,” the precursor to what we today understand as marketing automation.

Join For More Marketing Automation Insights

The marketing automation industry has been expanding steadily for nearly three decades—and it shows no sign of stopping. It’s worth billions of dollars and is poised to more than double in value by 2029, with much of that growth happening in established markets like North America, as well as Asia-Pacific.

To be sure, there are challenges: the industry desperately needs more qualified automation specialists, and customers continue to struggle not only with choosing their marketing automation software but integrating it with their ever-growing martech stacks. But on the whole, the opportunity for existing marketing automation platforms, as well as new entrants, is vast. Artificial intelligence will be an especially strong driver of growth over the coming few years; as AI makes all aspects of marketing more efficient, marketing automation tools are an ideal way for consumers and businesses to access those benefits through a platform they’re already familiar with.

Looking for more articles covering the latest trends in marketing automation? Check out our guide on How to Implement AI in Marketing Automation. We've also got a treatise on marketing automation statistics if numbers are your thing. And make sure to subscribe to The CMO newsletter for regular industry updates, marketing strategies, and leadership insights.